The Game-Changer For The Insurance Industry: Mobile Apps Targeting Digital Natives

Over the years, mobile applications have been gaining more importance in our lives. With over 2.7 billion smartphones worldwide, it’s no surprise that the mobile app industry is thriving. App usage and smartphone penetration are still growing at a steady rate, without any signs of slowing down soon. Indeed, the mobile app market is expected to generate over 9935 billion U.S dollars by 2023.

Mobile applications have emerged as the game-changer for every industry, and the insurance sector is no exception. With the advancement of technology and the continuously increasing customer expectations, modern customers are already used to buying and managing everything with their smartphones – and insurance products are not different.

Mobile apps help the insurance industry in many ways, for instance, they help to increase efficiency, customer satisfaction, user engagement, loyalty, etc. Additionally, insurance companies can simplify complex processes and reduce paperwork to a greater extent. Let’s dig in some of the benefits the insurance companies can get from mobile apps.

Benefits of a mobile application for insurance companies

Automation of processes

Modern digital platforms automate and therefore, simplify all the business processes. For instance, the Moflix Interaction Platform offers the opportunity to automate processes such as taking orders, processing bills, collecting payments, etc.

Increase revenue opportunities

Using mobile apps in an organization offers the opportunity to simplify expensive and cumbersome processes, saving companies a great amount of money. Besides, great mobile products paired with attractive services can easily deliver a competitive edge improving customer retention and loyalty.

Digital customers – catering to new generations

Modern customers are used to buying and managing everything with a smartphone, and they expect to have an outstanding customer experience while doing so. Once customers commit to an insurance provider, they expect to be able to use mobile technology to make payments, access and manage their accounts.

As consumer demands will continue to increase, digital mobile platforms become the perfect ally for meeting these demands by making interactions with customers much more meaningful. A good mobile application can keep customers’ attention for longer and encourage them to use more products.

Personalized offers – deliver what customers want

Apps allow companies to collect information on each client. This becomes handly when improving the quality of personalized offers. Providing your customers with a unique offer based on the data received can improve customer retention and loyalty.

Seamless digital customer experience

As mentioned before, the modern buyer expects to complete everything online. Offering your customers a seamless converge between traditional and digital interactions, will win their hearts and transform them into loyal customers.

🚀 Check: Being truly digital in the telecom industry: BSS automation 🚀

Benefits for users

Online consultation – Excellent digital customer experience

A person cannot always find the time to visit one of the insurance companies in person to consult on a matter of interest. Having the information and tools to get the desired services at a fingertip away, will make a difference for users when choosing an insurance provider.

Real-time customer service

One of the greatest benefits of technology is the real-time communication. Mobile apps enable businesses to interact with a customer instantly and offer them a more personalized experience. One of the best ways to connect with your customers and enhance customer experience is by being there whenever they need you.

Convenient data storage

Another advantage of the mobile apps is that all neccesary information can be stored in a single interface and accessed at anytime.

A Versatile Mobile Platform For Insurance Providers

There are so many other benefits insurance companies can get from having a mobile platform for digital services. Thanks to tech-advanced mobile applications, companies can serve better their customers and stay a few steps ahead of the competition.

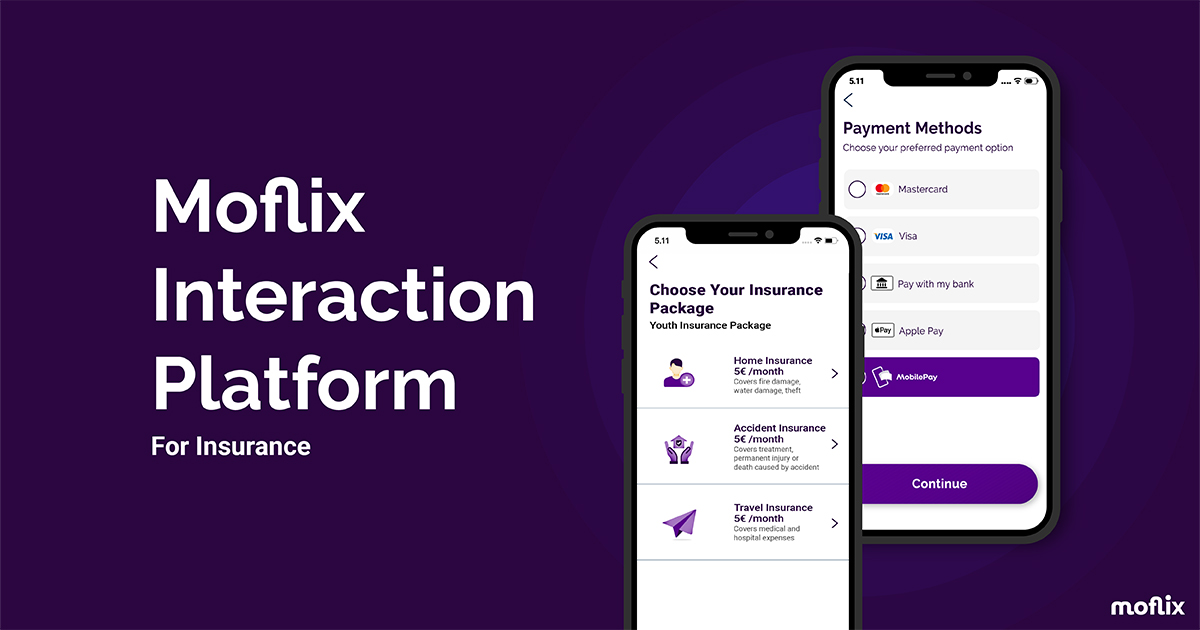

The Moflix Interaction Platform is a fully app-based solution created for companies that courageously seek out modern solutions for customer onboarding with strong identification, in highly regulated environments. Our onboarding solution can be integrated to existing architectures in record time. Some of the key features of the Moflix platform are:

- Seamless, fast and easy to use

- Fully digital customer onboarding

- Policy management

- Customer management

- WhatsApp ticketing

- FAQ

- Push notifications

The Moflix interaction platform is designed to cater to the modern buyer. Through the app, users can set-up and manage their accounts and subscriptions, manage their entire onboarding process, receive real-time assistance (support channel based on existing instant messaging platforms, such as WhatsApp) and make payments, all at a fingertip.

Interested? Contact us and start transforming your operations into a future-proff business.